House Bill 487: Cuts and corrections

April 04, 2012

House Bill 487: Cuts and corrections

April 04, 2012

Download briefDownload summaryPress releaseEven though there is no budget shortfall, Ohio Gov. John Kasich and House Republicans propose squeezing $95 million out of Ohio’s current budget without using the money to restore critical services. The bill does not include a defined plan for use of the funds cut from various agencies.

Executive summary

The new Mid-Biennium Review (HB 487) contains the budget corrections that typically come at this point in the policy process. But it also has so many disparate elements that it may be broken up into separate bills. The heart that will remain – corrections and adjustments – will yield a net $95 million cut across agencies. Yet there is no budget shortfall. What will the money be used for?

There is a lot of language in HB 487, but no defined plan for use of the 1 percent budget cut all agencies were asked to offer up. In the context of Ohio’s $112 billion biennial budget, a cut of this size – $95 million is not quite a tenth of 1 percent – is relatively small. But to the 14,000 Ohio families waiting for services from the Department of Developmental Disabilities, it is enormous. According to the Ohio Association of County Boards, if we spent just $8 million, we could secure federal matching funds to expand services and reduce the wait. Just $6.2 million could stop the cut pending in the coming fiscal year to alcohol and drug treatment services, funding treatment for an estimated 3,800 Ohioans. According to the Public Children’s Services Association of Ohio, Ohio provides the nation’s lowest level of support for local child welfare; $20 million could make life safer and more secure for struggling Ohio children.

There is a lot of language in HB 487, but no defined plan for use of the 1 percent budget cut all agencies were asked to offer up. In the context of Ohio’s $112 billion biennial budget, a cut of this size – $95 million is not quite a tenth of 1 percent – is relatively small. But to the 14,000 Ohio families waiting for services from the Department of Developmental Disabilities, it is enormous. According to the Ohio Association of County Boards, if we spent just $8 million, we could secure federal matching funds to expand services and reduce the wait. Just $6.2 million could stop the cut pending in the coming fiscal year to alcohol and drug treatment services, funding treatment for an estimated 3,800 Ohioans. According to the Public Children’s Services Association of Ohio, Ohio provides the nation’s lowest level of support for local child welfare; $20 million could make life safer and more secure for struggling Ohio children.

Policy Matters’ analysis of the bill found that good timing and favorable terms generated savings in debt service. This was the largest contributor to the reductions across line items. It reduced lease rental payments in agencies and saved millions of dollars for the Ohio School Facilities Commission and for the Public Works Commission. Reductions in federal lines also contributed to reductions. This occurred, for example, in a line item within Developmental Disabilities used to correct a payment glitch of earlier years, and in a line item within the Rehabilitation Services Commission attributable to a federal hiring freeze. However, red ink spreads in smaller amounts across programs even within agencies that come out in the black.

Ohio families depend on public services in the most critical areas of life: care and education of children, career preparation for young adults, assistance for the elderly, public transit to get to work, health standards that prevent injury and disease. Ohio let public services erode over this past decade, and slashed the current state budget. The damage of these cuts is just now being felt.

This issue brief focuses narrowly on the budget corrections of HB 487, one of the first MBR bills out of the chute. As the bill is restructured and other bills move through hearings, we will look at revenue recommendations, energy, education and development proposals.

The Kasich Administration outlines new policy directions and budgetary changes in a group of bills introduced as part of a process they call the “Mid-Biennium Review” (MBR). The first bill to come out of the MBR, House Bill 487, contains the corrections and adjustments typically offered at this time in the biennial budget cycle. HB 487, however, is not typical. It contains so many disparate elements it may be split into separate bills. It is accompanied by other bills, ranging from capital appropriations and re-appropriations to a set of new initiatives in energy, education and economic development.

The defining characteristic of the multi-faceted HB 487 is another round of budget cuts. These new cuts come in the middle of a brutal budget that slashed schools by nearly $2 billion and local governments by $1 billion, leaving students praying for school levies and local governments dimming street lights, closing fire houses, abandoning road maintenance and reducing waste collection.

In this issue brief, Policy Matters Ohio focuses narrowly on the budget corrections of HB 487. We will turn our attention to revenue recommendations and non-budget elements of HB 487 as the bill is restructured in the House, as well as to the companion legislation that will be considered over the course of a busy spring at Statehouse Square.

Overview

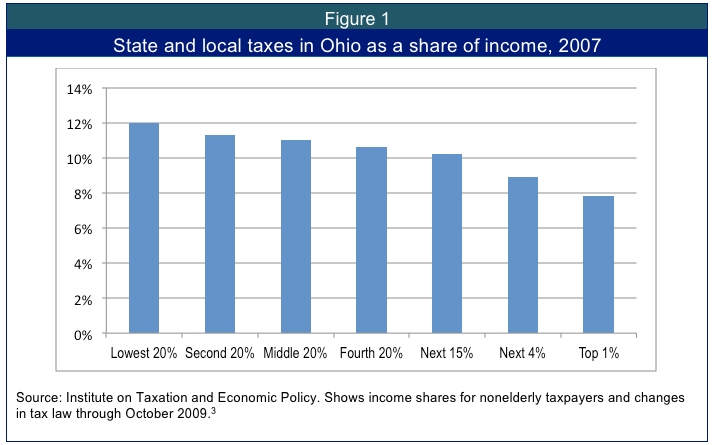

The state budget is still in balance, but House Bill 487 reduces appropriations by a net $95 million, even as 14,000 Ohioans wait for services under the Department of Developmental Disabilities[1] and as up to 20 percent of school districts prepare to implement fees for extra curricular activities (“Pay to play”).[2] It takes $123 million out of funding for state services on an all-funds basis and adds back $28 million in new investment. Reductions total $3.1 million for FY 2012 and just under $92 million for 2013. The cross-agency legislation affects budget line items in 36 agencies, about a third of the 110 state government departments covered under the current state main operating budget (HB 153), plus the Department of Public Safety within the Ohio Department of Transportation, the Bureau of Workers Compensation, and the Ohio Industrial Commission. More three quarters of total reductions stem from budgetary adjustments in just six agencies (see Figure 1):

- The Ohio Department of Developmental Disabilities (DDD) sees a reduction of $33.4 million in the total operating budget as lease rental costs go down due to lower than expected debt service requirements and less spending authority is needed in a federal line to correct a glitch in payments under a protocol phased out in 2005.

- The Revenue Distribution Fund (RDF) disburses new casino revenues of almost $20 million to the Ohio State Racing Commission Fund ($8.5 million), the Department of Alcohol and Drug Addiction for problem gambling ($5.7 million), and the Attorney General’s office for the Ohio Law Enforcement Training Fund ($5.7 million).

- The Ohio Board of Regent’s total operating budget is reduced by $16 million, almost half ($7 million) related to facilities funding.

- The Ohio School Facilities Commission benefits from the state’s favorable debt refinancing, which reduces debt service payments by $12 million.

- The Rehabilitation Services Commission sees adjustment of $10 million in non-GRF (federal) funds for Disability Determination.

- The Ohio Public Works Commission sees costs lowered by $7 million due to favorable terms of the state’s debt refinancing.

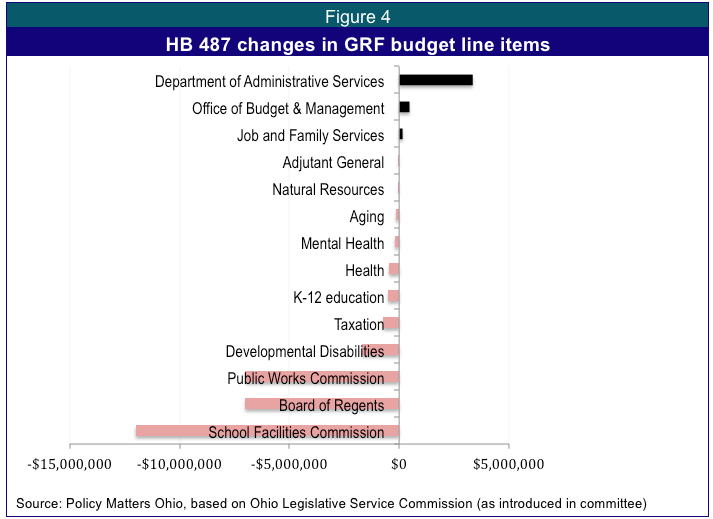

Funding increases are not common but several agencies see net gains (Figure 2):

- The Ohio State Racing Commission Fund receives casino monies via the Revenue Distribution Fund for operations ($8.5 million).

- The Ohio Department of Alcohol and Drug Addiction Services (ODADAS) receives funds for gambling addiction from casino revenues ($5.7 million);

- The Attorney General’s office receives casino funds for law officer training ($5.7 million).

- The Ohio Environmental Protection Agency takes over a set of recycling and waste reduction programs from the Ohio Department of Natural Resources ($4.5 million), and

- The Department of Commerce receives appropriations for reorganization of liquor control operations changed with the privatization of the liquor wholesale function ($3 million).

- The Department of Administrative Services nets increases from the combining of construction and facilities programs and new information technology programming ($1.2 million).

- The Office of Budget and Management sees full funding of the Office of Health Transformation, putting the department in the black, despite some line item cuts.

General Revenue Fund/Non-GRF Changes

The General Revenue Fund (GRF) is considered the part of the budget that best reflects the choices of elected officials. Non-GRF funding, such as funds received from the federal government, or fees, or funds with defined purposes (like some of the new casino revenue funds) are shaped by outside forces: Congress, the market, the level of fees, statutory or constitutional definition. Taxes fund the GRF, and elected officials make decisions about how to allocate those monies. Legislative intent can be best understood by analyzing changes within the GRF. Over time, however, a growing share of state services has been funded outside of Ohio’s General Fund. Figure 3 compares state funds in the budget to non-GRG funds since 1997. Today non-GRF funds support more in public services than tax dollars in the GRF. Review of changes in non-GRF appropriations has become important, in spite of less controllable characteristics, as these funds increase in the budget.

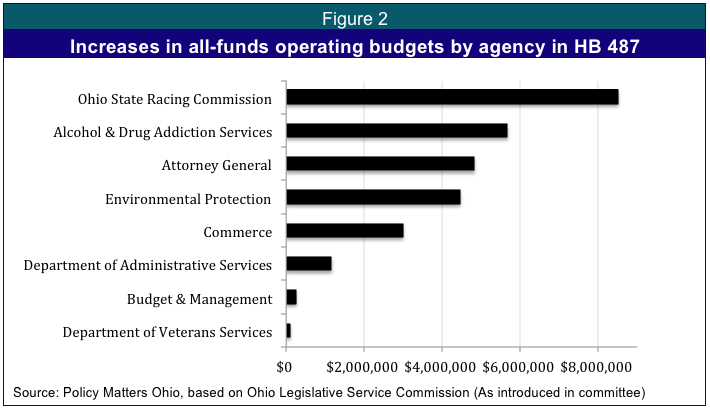

In House Bill 487, 27 percent of net budget changes are made within the GRF, compared to 73 percent in non-GRF funds. By and large, changes in the GRF mirror that of the all-funds budget. Figure 4 below shows the overall changes in budget areas and the bullets below describe some of the interesting details not all of which can be captured by the figure. Within the GRF lines included in HB 487, the largest reductions are due to savings in debt service (School Facilities, Public Works Commission) and changes within the Ohio Board of Regents. Other changes include:

- The Department of Administration Services nets about $3.3 million in new GRF funds due to the consolidation in facilities and construction functions and new information technology initiatives described above.

- Early care screening for developmental disabilities is boosted by $300,000. However, the agency’s GRF reductions are not fully recycled internally – for instance, to address a waiting list of thousands.[3] In hearings, advocates suggested $8 million could draw down a federal match for a total of $21.1 million to meet the needs of Ohio individuals and families.

- Even though Figure 4, below, shows the overall budget of the Department of Mental Health is reduced, the agency receives $3 million to fund community services. Here, the $2 million reduction in lease rental payments and $1 million reduction in hospital administrative services appear to be internally reallocated for community mental health services.

- The Office of Health Transformation is funded within the Office of Budget and Management at about $500,000 (Another almost $300,000 comes from non-GRF federal sources).

- The Department of Health sees reductions of $705,000, the one percent reduction requested of all agencies. However, the cuts are taken from just four programs within the agency:.7 percent from the GRF line for immunizations; 4.4 percent in ‘Local Environmental Health;’ 3.3 percent in GRF funding for Federally Qualified Health Centers and 2.5 percent in ‘Chronic Disease and Injury Prevention.’

Reorganization and renaming

In a number of budget lines, funding sources are merged into new line items or reorganization is reflected in funding changes.

- The Medical Revenues and Collections line item in Job and Family Services is merged with the Medicaid Program Support line item; an $82 million dollar ‘loss’ in one shows up as an increase in the other. Both are to be renamed: “Health care/Medicaid Support-Recoveries.”

- $178 million is reallocated from a program identified with adoption to one identified with foster care; both are renamed. There is no impact on the agency’s bottom line.

- Veterans and employment services programs are combined in a renamed ‘Workforce Programs’ line item: the $41.9 million is consolidated, moved and renamed within the Job and Family Services budget.

- Three DAS line items: Equal Opportunity Certification (Line item 100439), Minority Affairs (Line item 100451) and Construction Compliance (Line item 102321), are combined into a new category, Equal Opportunity Services (Line item 100457).

Other language in HB 487

Themes emerging in the non-budgetary language of House Bill 487 that we will track in subsequent analysis of the Mid-Biennium Review include:

- Authority for privatization is expanded to the ancient public service of verifying weights and measures. Public health inspections of manufactured home parks may be contracted out. Authority for sale/leaseback of public assets is extended to state and county facilities.

- Transparency is reduced by eliminating or weakening stakeholder boards. The public health council, which advises the Director of Health on implementing programs and shaping rules, is eliminated and its duties assigned to the Director of Health. Authority is clarified as residing in the Administrator of the Rehabilitation Services Commission instead of the Commission itself.

- Reporting requirements are relaxed as HB 487 eliminates the requirement that ODJFS report twice a year on the characteristics of individuals participating in or receiving services from programs the agency operates. It also reduces reporting required on Medicaid cost containment.

- Stakeholders identify unfunded mandates. For example, four hours of training will be required for officers and troopers but the funding to reimburse local police forces for staff time spent in required training is eliminated. Early care, schools, and other institutions serving children will be required to meet the requirements of the state ‘Step Up To Quality’ program, which is expected to increase costs for programs, but funding for the improvements has not been identified.

Summary and recommendations

Apart from the non-budgetary language, HB 487, the first bill of the Mid-Biennium Review, resembles ordinary corrections bills. What is out of the ordinary is that significant reductions are made, yet not reinvested. How will the net $95 million squeezed from the current lean state budget be used? The rainy day fund? More tax cuts? These options are discussed, but restoration of funding for schools, local governments, and other public services are not part of the conversation. They should be.

Working Ohio families depend on public services in the most critical areas of life: in care and education of children, career preparation for young adults, assistance for the elderly, public transit to get to work, local health standards that prevent injury and disease. Ohio let public services erode over this past decade, and slashed the current state budget. The damage of these cuts is just now being felt. Savings from HB 487 should be directed toward rebuilding these services, and legislators should engage in a serious discussion of how to fairly bolster the state’s revenues and ensure that last year’s cuts do not become a new baseline for public services.

[1] Dustin McKee, Ohio Association of County Boards Serving People with Developmental Disabilities, Testimony on HB 487 before Health and Human Services Subcommittee, House Finance Committee, 3/22/12.

[2] Policy Matters Ohio, The State Budget and Ohio’s Schools, January 2012.

[3] See footnote #1.

Tags

2012Budget PolicyWendy PattonPhoto Gallery

1 of 22