Three blows to local government: Loss in state aid, estate tax, property tax rollback

July 24, 2013

Three blows to local government: Loss in state aid, estate tax, property tax rollback

July 24, 2013

Download summary (1 pg.)Press release (1 pg.)Download report (6 pgs.)We can expect to see continued loss of local services, from dimmed streetlights to closed pools, curtailed senior services and furloughed police and firefighters. This hurts families and may erode property values. Instead we should support localities and boost the Ohio economy.

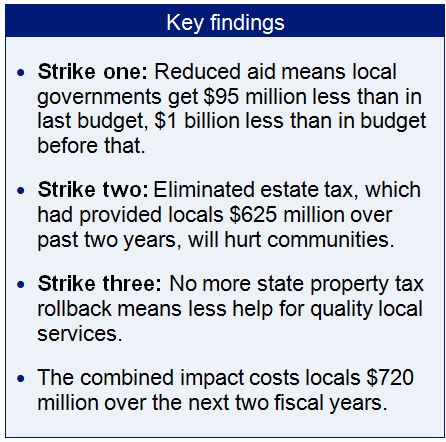

The state has delivered three hard blows to local communities in the new state budget. First, it is providing $95 million less in local aid over the next two years when compared to the 2012-2013 budget, and $1 billion less when compared to the 2010-2011 budget. Second, the loss of the estate tax will clobber locals: It provided $625 million to communities over the last two years, money that won’t be available in the future. Finally, the state has started to get rid of the local property tax rollback, a complicated-sounding phrase that simply means that when communities chose to pay more for good schools and other quality local services, the state used to help with that cost. The state has eliminated that aid for new and replacement levies.

The state has delivered three hard blows to local communities in the new state budget. First, it is providing $95 million less in local aid over the next two years when compared to the 2012-2013 budget, and $1 billion less when compared to the 2010-2011 budget. Second, the loss of the estate tax will clobber locals: It provided $625 million to communities over the last two years, money that won’t be available in the future. Finally, the state has started to get rid of the local property tax rollback, a complicated-sounding phrase that simply means that when communities chose to pay more for good schools and other quality local services, the state used to help with that cost. The state has eliminated that aid for new and replacement levies.

Altogether, local governments face the next two fiscal years with $720 million less revenues for local services. They have $1.5 billion less than in FY 2010-11. The result is that dimmed streetlights, furloughed emergency workers and reduced pool hours are likely to continue and to increase.

Losses are caused by cuts to revenue sharing, elimination of local taxes, and loss of property tax relief:

- The Local Government Fund, established eighty years ago, has been cut in half.

- Tax replacement payments, promised when the state eliminated local taxes, have been cut.

- The estate tax has been eliminated, effective this year.

- State property tax relief has been curtailed, with local losses anticipated in 2015 and beyond.

- Revenues from casino gambling, which provide new resources to localities, offset only a small share of the loss.

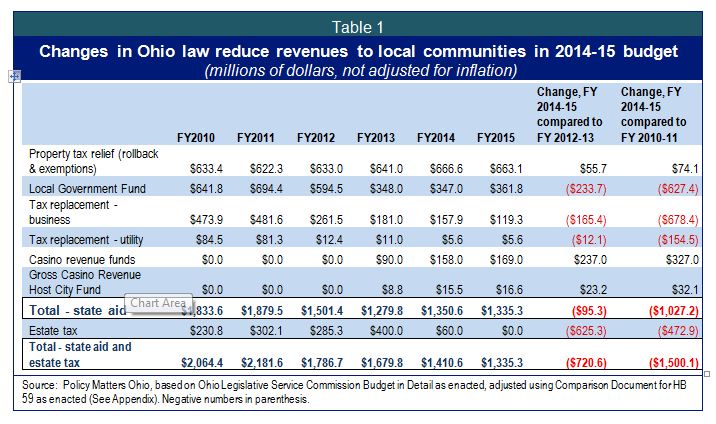

Figure 1 on the next page shows the change in state aid over four years to local government, including the estate tax, property tax rollback, casino revenues, tax replacements, and Local Government Fund.

Local Government Fund: For about 80 years, the state of Ohio has shared revenue with localities through the Local Government Fund (LGF). Established as a revenue sharing program to help counties with the diverse needs of their residents, the LGF was chopped in half in the last budget. The reduced level of funding was made permanent in the new budget bill.

Estate tax: For more than forty years, Ohio allowed local governments to levy a tax on the wealthiest estates. The vast majority of estates were never subject to the tax (only 8 percent were), and even those estates that were taxed could still pass on at least 93 percent of their wealth. Eighty percent of the estate tax funded local government services. But that source of support was eliminated in the last budget, a provision that went into effect at the beginning of this year.

Tax replacements: When state government eliminated local taxes on public utilities and then on commercial and industrial tangible personal property, part of the agreements included long-term repayments to localities for the revenues that were lost. It was assumed that gains in economic development would replace losses over a dozen years, and tax replacements were in come cases scheduled to be phased out, although some replacements were to continue indefinitely. These replacements were eliminated, greatly accelerated or curtailed in the last budget.

Property tax relief: The property tax rollback, also called property tax relief, has been the largest source of unrestricted state aid to local government. Providing this help was part of the reason why Ohio established an income tax in the 1970s. As urban areas grew, home values rose and with them, property taxes. Concern about rising property taxes prompted Ohio to establish a progressive income tax, and use some of the revenues to pay 10 percent of local levies, known as the property tax ‘rollback.’ In 1979, an additional 2.5 percent was added to the rollback covering owner-occupied homes.[1]

House Bill 59, the new budget bill, starts to dissolve this agreement by making new and replacement levies ineligible for the 12.5 percent rollback. For those levies, homeowners will now pay more. Although overall property tax aid will grow in FY 2014-15 as property values recover from the recession, the effect of the new provision is evident in FY 2015. Elimination of the rollback is expected to take $12 million from local budgets in 2015. Another provision, which limits property tax relief for seniors to those of low income, may take up to an additional $3.2 million.[2]

Here is an example of how the elimination of the property tax rollback would work. Voters in Parma will decide this November whether to raise their property taxes to pay for fire safety equipment. Under past law, the owner of a home worth $79,000 would have paid just $48 more for that increase. Without the rollback, that homeowner would be paying about $55 a year more.[3] The elimination of state aid now applies only to new and replacement levies, and other types of levies are still covered by the rollback, but over time, state property tax rollbacks will decline.

In addition, extra property tax relief for seniors will be means tested: only those of low income will receive help with their property tax now. The rest will pay their property tax at the same level as everyone else, without state assistance. Means-testing this provision of the law, known as the homestead exemption, makes good sense, so that it is limited to those who need it. This reduces funds the state sends to local governments, but it does not reduce local funds, since homeowners will pay their property tax bill in full. As with the elimination of the property tax rollback, this could make it more difficult to pass operating levies for schools and other services: city and county operations, emergency services, public health, mental health, developmental disability services, libraries and other services funded locally in Ohio.

Casino gambling provides a new source of funding to counties, cities and schools. While this source is increasing, it does not replace the losses locals have seen.[4]

Figure 2 presents a different view of state revenue sharing with local governments over three biennial budgets. The loss of estate tax collections is also portrayed.

When the loss of estate tax revenues are counted, local governments will have $720 million less in FY 2014-15 than in FY 2012-13 and $1.5 billion less in 2010-11. Table 1 outlines the specific funding changes to local governments over the past three biennia:

- Property tax relief through the rollback and the homestead exemption are expected to rise in the current biennium compared to the prior by $55.7 and by 74.1 compared to FY 2010-11, but that growth will be clipped in future years by elimination of the rollback from new and replacement levies, and means testing of the homestead exemption.

- The Local Government Fund provides $234 million dollars less for local government in the new biennial budget for FY 2014-15 than the last one. It provides $627 million less than the level of FY 2010-11.

- Tax replacements over the FY2014-15 period will fall $178 million below the last budget, and by $833 million below FY 2010-11.

- The estate tax, eliminated in 2013, provided communities with an estimated $625 million for local services in FY 2012-13, funds that will not be available in the current biennium. It provided $473 million in FY 2010-11.

- New casino revenue funds, most of which are constitutionally allocated to local governments and schools, will provide $359 million to county funds and host cities in FY 2014 and 2015.

Overall, in FY 2014-15, state aid to local governments provided directly in the budget will fall by $95 million compared to FY 2012-13 and by $1 billion compared to FY 2010-13. Other budget or law changes also impact local budgets: when loss of the estate tax and gains from casino revenues are taken into consideration, local governments will be working with $720 million less in FY 2014-15 than in the last budget, and $1.5 billion less than in the two-year budget period prior to that (Table 1).

Summary and conclusion

The revenue sharing that has long supported local communities in Ohio has changed dramatically over the past two years, and will change more during the next two. The state is taking in money that once went to support local communities.

The Department of Taxation estimates that state General Revenue Fund increases attributable to changes in the tax replacements to local governments and schools totaled $601 million in FY 2012 and $844 million in FY 2013.[5] Reductions in the Local Government Fund from FY 2010-11 funding levels[6] may be estimated at about $104 million in 2012 and $425 million in 2013; these funds, too, were retained by the state’s General Revenue Fund. Added together, $700 million in 2012 and $1.2 billion in FY 2013 went to the state instead of to local government. Increases in state tax collections over the past two fiscal years was due in part to timing of income tax payments - people cashed in their investments early because they thought federal taxes on investment income would increase[7] - but it was also due to state retention of almost two billion dollars formerly provided through revenue sharing to schools and local governments.

Different policies would have helped local government more than the budget passed by the legislature . The broadened sales tax base in Governor Kasich’s initial Executive Budget proposal could have provided an estimated $120 million over the biennium to counties and transit authorities.[8] Medicaid expansion proposed by the Governor but not yet implemented could bring $48 million in expanded tax revenues to local governments in 2015.[9] The severance tax, also proposed in the Executive Budget, could have provided resources for impacted counties. Moreover, provisions for adjusting the property tax to cover natural gas liquids - of interest in the Utica shale formation - were also lost in the budget process. Most importantly, the budget contains nearly $1.5 billion in net revenue losses over the next two years because of reductions in income-tax rates and new exemption for business income. These funds could have been used to restore support to local communities.

State leaders should do more to help local communities provide high quality schools, public safety, recreation and infrastructure. Revenue sharing with local governments, libraries and schools has been the way Ohio helped for decades. Better support to Ohio communities will ensure stable, high-quality local public services, boosting family property values, opportunity and wealth. This is an important way to keep the economy of Ohio in good shape for the future.

Policy Matters Ohio is grateful for support from the Ford Foundation, the Cleveland and Gund Foundations, and the Center on Budget and Policy Priorities, which underwrite the production of this report. The author appreciates the assistance of interns Shubo Yin, Brian Williams and Ryan Thombs.

[1] Dave Scott, “Eleventh hour change in property tax rollback will hurt homeowners,” Akron Beacon Journal, July 7, 2013 at http://www.ohio.com/news/local/11th-hour-change-in-ohio-property-tax-structure-will-cost-homeowners-1.411358

[2] Ohio Legislative Service Commission, , “Comparison Document” for House Bill 59 (as enacted) at http://www.lsc.state.oh.us/fiscal/comparedoc130/enacted/default.htm

[3] Bob Sandrick, “Parma places fire equipment levy on November ballot,” Sun News, July 11 2013 at http://www.cleveland.com/parma/index.ssf/2013/07/parma_places_fire_levy_replace.html

[4] Zach Schiller, “No Windfall: Casino taxes won’t make up cuts to local governments,” Policy Matters Ohio, October 8, 2012 at http://www.policymattersohio.org/casino-taxes-oct2012

[5] “Explanation of law changes enacted in 2011 relating to the reimbursement of foregone tangible personal property taxes and modifications to state tax revenue streams” Ohio Department of Taxation, May 1, 2012 at http://www.tax.ohio.gov/portals/0/personal_property/TPR_Reimb_Electric_Gas_Dereg_Reimb_May2012.pdf

[6] Under prior formula funding, 3.68 percent of GRF tax revenues were provided to the Local Government Fund. This was reduced by half during FY 2012-13.

[7] “Because of this acceleration of income <referring to how uncertainty around federal tax rates encouraged higher income households in accelerate income – capital gains, bonus income and dividend payments – into 2010> FY 2013 income tax revenues have soared far beyond their FY 2012 levels and beyond OBM’s original estimates...” Timothy S. Keen, Director, Amended Substitute Bill 59, Conference Committee Testimony on the FY 2014-15 Main Operating Budget, June 18, 2013 (Obtained from the Gongwer Report website).

[8] Ohio Office of Budget and Management, Executive Budget for 2014-15, “Budget Recommendations” Counties and transit authorities would have been eligible for even more under the proposal, except that it would have ill-advisedly capped the amount they received from the base-broadening.

[9] Ohio Medicaid Expansion Study, “Expanding Medicaid in Ohio: County-level analysis” and “Expanding Medicaid in Ohio: County-level analysis part 2: Local economic impact on employment and general sales tax revenues,” March 2013 at http://www.healthpolicyohio.org/resources/publications/

Tags

2013Budget PolicyLocal GovernmentRevenue & BudgetWendy PattonPhoto Gallery

1 of 22