Small Investment, Big Difference: How an Ohio Earned Income Tax Credit would help working families

March 15, 2013

Small Investment, Big Difference: How an Ohio Earned Income Tax Credit would help working families

March 15, 2013

Press releaseDownload summaryDownload reportA credit set at 20 percent of the federal credit would provide working families with an average of $446 annually. The EITC helps keep families with children above the poverty line, makes work pay, and sends dollars to local communities.

Gov. John Kasich has proposed major changes in Ohio’s tax system, including broadening the sales tax to cover most services, cutting the sales-tax rate, slashing income taxes and giving business owners a big tax break. Together, the impact of these changes will be to cut needed revenues, while transferring income from poor and middle-income Ohioans to the affluent.[1]

Gov. John Kasich has proposed major changes in Ohio’s tax system, including broadening the sales tax to cover most services, cutting the sales-tax rate, slashing income taxes and giving business owners a big tax break. Together, the impact of these changes will be to cut needed revenues, while transferring income from poor and middle-income Ohioans to the affluent.[1]

Broadening the sales tax base while cutting the state rate to 5 percent would produce significant needed revenue and make the sales tax more viable long-term, since more and more of the Ohio economy is based on services. The problem: Low- and moderate-income Ohioans would be most affected, as they would pay the most as a share of their income.[2] And low-income Ohioans already pay more of their income in state and local taxes than rich Ohioans do.[3]

If Ohio is going to broaden the tax base, the state should adopt a state Earned Income Tax Credit (EITC), as 25 states (including the District of Columbia) have done. It is good policy at any time, especially when legislators are considering raising taxes on those least able to pay. An EITC not only helps create a more fair tax structure, it provides a boost to local economies, as EITC dollars are often spent and saved locally. This multiplier effect creates local and state tax revenue based on goods and services that are sold. Below we review the successes of the federal EITC and how it can be implemented in Ohio.

The federal EITC works

The federal Earned Income Tax Credit does more than any other program to keep working families out of poverty. Created under President Ford in 1975 and expanded under every presidential administration since, the EITC is lauded for its direct impact in keeping families with children above the poverty line, making work pay, and sending federal dollars to local communities. The EITC is delivered through the tax code and those who qualify receive it in the form of a tax refund.

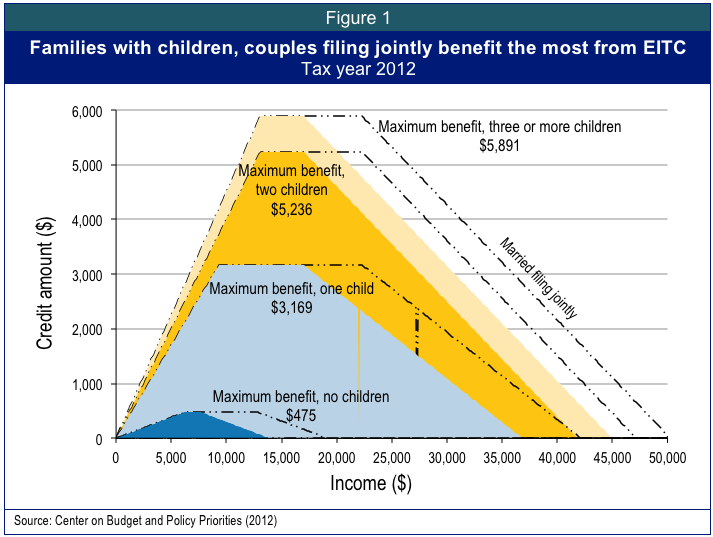

To qualify for the EITC (for tax year 2012), workers must have earned income of $50,270 or less. The credit is worth substantially more for families with children and is refundable, which means families receive cash refunds above their tax liability. Figure 1, below, shows that married couples with children qualify for larger credits and can earn more income before the phase-out of the credit. For low-income workers without children, the maximum credit is small, $475, and they are no longer eligible when income is above $20,000. The EITC encourages families making at or near minimum wage to work more hours since the credit has a longer, more gradual phase-out range compared to other programs.

Federal EITC already benefits Ohio

In Ohio, the federal EITC helped more than 950,000 families (20 percent of all tax filers) in tax year 2011 and brought more than $2 billion to local communities.[4] The average federal EITC refund in Ohio was $2,238, often equaling two or three months of pay for a low-wage working family. Research shows that families use their refunds for basic needs, to pay for child-care expenses and to save.[5] A state EITC program would not be large in comparison with the estimated state General Revenue Fund spending of $27.7 billion in Fiscal Year 2013 (see Table 1, below).[6] A modest Ohio EITC program, set at 10 percent of the federal credit, would provide the average recipient $224 and would cost the state $184 million per year. A slightly more generous credit, set at 20 percent of the federal credit as in many states, would cost about $367 million per year and would provide families with an average of $446 annually.

State programs supplement federal efforts

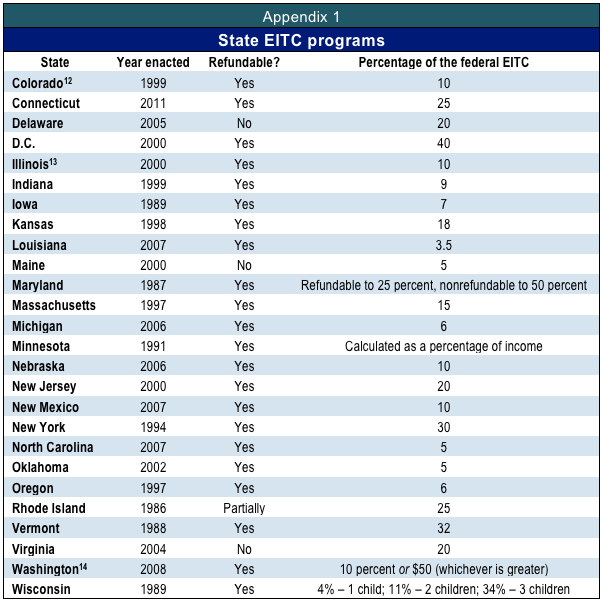

The federal EITC is so effective that 24 states and the District of Columbia have enacted their own state-level programs (see Appendix 1). Most of the state EITC programs are refundable, ranging from 3.5 percent to 50 percent of the federal credit. States with EITC programs have a variety of personal income and sales tax structures. A state EITC enables families to work and build assets while reducing the impact of regressive income-tax changes occurring over the last 20 years. The idea makes sense because the state and local tax system is slanted against low-income Ohioans, who pay a larger share of their income in such taxes than affluent Ohioans do.[7]

The impact of a state EITC program in Ohio

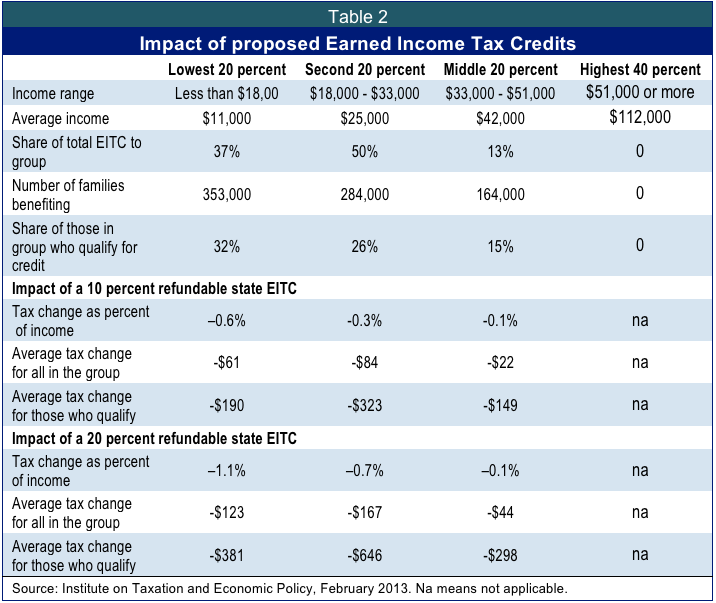

Table 2, below, breaks down the two potential Ohio EITC programs at a more detailed level.[8] A national tax research group, the Institute for Tax and Economic Policy (ITEP), modeled how an EITC would impact taxpayers in Ohio. The ITEP model separates Ohio families into five groups, or quintiles, based on level of income. Each quintile contains an equal number of families. The impact of a 10 and 20 percent refundable Ohio EITC is modeled against the current income tax rate structure. Under both models, the EITC program would help the middle, second, and lowest 20 percent of families in Ohio. Below, we discuss the 20 percent credit in detail.

For qualifying families in the lowest quintile, with incomes less than $18,000 in 2012, the average credit would be $381 or 1.1 percent of income. This lowest quintile, with an average income of $11,000, would receive 37 percent of the state EITC program benefits or $135 million. This would benefit an estimated 353,000 families.

For qualifying families in the second quintile, with incomes between $18,000 and $33,000, the average credit would be $646 per claiming family or .7 percent of income. The second quintile, with an average income of $25,000, would receive the largest portion of the state EITC program (50 percent) or $184 million. One quarter of taxpayers in this quintile would receive some state EITC credit.

The final group affected by a state EITC program would be the middle quintile, which ranges from $33,000 to $51,000, and has an average income of $42,000. This middle group would receive an average credit of $298, around .1 percent of income. Approximately one in seven of these middle-quintile taxpayers would receive some portion of an EITC.

Why a state EITC makes sense for Ohio

A state EITC makes sense for a variety of reasons. The policy:

- Makes the tax system fairer. Low and moderate-income working families pay their share of income taxes, pay into Social Security and Medicare, and pay sales and excise taxes. As noted above, low and moderate-income families pay a larger share of their income than upper-income Ohioans do when all state and local taxes are considered.

- Rewards work. The federal and state EITC can only be claimed by people who earn income. People who work full time should be able to support their families, but often live in or near poverty. The EITC makes it easier for working families to provide for basic needs, while encouraging work.

- Encourages healthy children and strong families. A recent wave of research finds that families claiming the EITC, often not in consecutive years, see better social and economic results. The EITC and similar work-based support programs lead to better school performance for children and stronger earnings over a lifetime of work. Children who benefit from the EITC work more hours and earn more later in life.[9]

- Generates economic activity. Families that claim the EITC use the refunds to pay for basic needs like housing, food, transportation and child care. These purchases stimulate local economies. A number of studies focusing on the economic impacts of the EITC find that small businesses and other taxes benefit from a cash infusion into the local economy.[10]

Additional concerns

The federal EITC is the largest poverty-relief program through the tax code but does not fully offset the impact of taxes on low- and moderate-income families. As noted in the ITEP analysis, the EITC does not cover more than half of Ohio taxpayers in the lowest three quintiles. This is because the EITC focuses on working families with children in their household, and many filers don’t fit that profile. A 10 percent state EITC would offset the increased sales tax in the governor’s tax proposal on average for those qualifying families in the bottom two-fifths of the income scale.

Thus, while an important policy in its own right, a state EITC would leave many low-income families unprotected from the regressive effects of a broader sales tax. A number of other states have implemented another policy, a sales tax credit, to ensure that a broad sales tax does not negatively impact low-income consumers, particularly those without dependent children. These credits provide a flat amount for each member of a family below an income threshold. In a forthcoming report, Policy Matters will provide an analysis of a sales tax credit in Ohio.

Conclusion

Tax systems need to deliver adequate revenue, while doing so fairly. Expanding the taxation of services is good policy. It allows the sales tax, which covers a narrow and shrinking base in Ohio, to grow with the economy.[11] However, it is imperative that low- and moderate-income families are not hurt by tax changes. A state Earned Income Tax Credit can reward work, keep children out of poverty, and strengthen families and communities. It makes sense at any time, and makes particular sense at a time when legislators are considering policies that will shift the tax load to lower-income families.

Policy Matters Ohio is a member of the Working Poor Families Project, a national initiative that advances state policies in the areas of education and skills training for adults, economic development, and income and work supports. WPFP supported this research on the EITC.

[1] Policy Matters Ohio, “Kasich Tax Proposal Would Further Tilt Tax System in Favor of Ohio’s Affluent,” Feb. 7, 2013, available at www.policymattersohio.org/tax-policy-feb2013. The governor’s proposal also includes an increase in the severance tax on oil and gas production from horizontal high-volume wells.

[2] Ibid

[3] Policy Matters Ohio, “Ohio’s State and Local Taxes Hit Poor and Middle Class Much Harder than Wealthy,” Jan.30, 2013, available at www.policymattersohio.org/income-tax-jan2013.

[4] IRS statistics as of June 2012, http://www.eitc.irs.gov/central/eitcstats/.

[5] Policy Matters Ohio, “Ohio needs a state earned income credit: 949,000 working families would benefit,” April 10, 2012, available at www.policymattersohio.org/eitc-april2012.

[6] Ohio’s Jobs Budget 2.0, Budget Highlights, The State of Ohio Executive Budget, Fiscal Years 2014-2015, p. 6, available at http://jobsbudget.ohio.gov/Highlights.pdf

[7] “Ohio’s State and Local Taxes Hit Poor and Middle Class Much Harder than Wealthy.” Ohioans in the bottom fifth of the income spectrum, who made less than $17,000 in 2010, on average pay 11.6 percent of their income in state and local taxes. By contrast, those in the top one percent, who made more than $324,000, on average, pay 8.1 percent.

[8] The ITEP analysis predicts fewer Ohio families claiming a state credit than received the federal credit in previous years. EITC claims have been at an elevated level over the past several years because of the economic downturn. The model predicts that as Ohio emerges from the recession, the number of EITC claimants is likely to decline.

[9] Dutta-Gupta, Indivar, “EITC Even Better for Children Than We Thought,” Center on Budget & Policy Priorities blog Off the Charts, July 12, 2012, available at http://www.offthechartsblog.org/eitc-even-better-for-children-than-we-thought/

[10] “Dollarwi$e Best Practices: Earned Income Tax Credit, 2nd Edition.” U.S. Conference of Mayors. 2008

[11] Schiller, Zach, Testimony to the Subcommittee of the House Ways & Means Committee on HB 59 sales-tax plan, March 7, 2013, available at www.policymattersohio.org/sales-tax-testimony-mar2013.

Tags

2013David RothsteinEITCTax PolicyPhoto Gallery

1 of 22