Income-tax cut would favor well-to-do

February 13, 2014

Income-tax cut would favor well-to-do

February 13, 2014

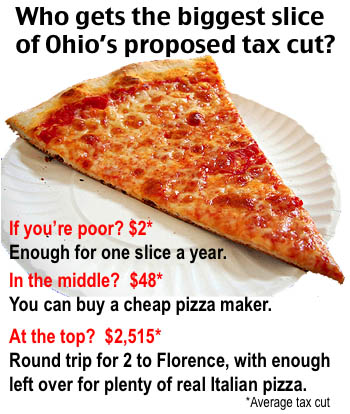

Download this report (2 pp)Press releaseAn across-the-board cut in rates favored by Gov. Kasich may allow low-income Ohioans to buy a slice of pizza a year, on average. Those in the middle could purchase a cheap pizza maker, while the state’s most affluent taxpayers could use their cut to go on a round-trip for two to Italy, with money left over to pay the hotel bill and buy some real Italian pizza.

Rate drop would average $2,500 for top 1%, $2 for the poor

Gov. John Kasich has indicated that he would like to see additional income-tax cuts that would bring the top rate for Ohio’s graduated tax below 5 percent. This report examines that proposal, and finds that the across-the-board cut in rates needed to accomplish that may allow low-income Ohioans to buy a slice of pizza a year, on average. Middle-income Ohioans could purchase a cheap pizza maker. For the state’s most affluent taxpayers, on average it would cover round-trip airfare for two to Italy, with some money left over to pay the hotel bill and buy some real Italian pizza.

Gov. John Kasich has indicated that he would like to see additional income-tax cuts that would bring the top rate for Ohio’s graduated tax below 5 percent. This report examines that proposal, and finds that the across-the-board cut in rates needed to accomplish that may allow low-income Ohioans to buy a slice of pizza a year, on average. Middle-income Ohioans could purchase a cheap pizza maker. For the state’s most affluent taxpayers, on average it would cover round-trip airfare for two to Italy, with some money left over to pay the hotel bill and buy some real Italian pizza.

Policy Matters Ohio previously noted that Senate Bill 210, a measure heard this week in Senate committee that would provide a 4 percent rate reduction, on average would provide enough for low-income Ohioans to buy a cheap cup of coffee each year.[1] Reducing rates to get the top rate below 5 percent would allow low-income Ohioans to go to Starbucks once a year and get a Grande Medium Roast.

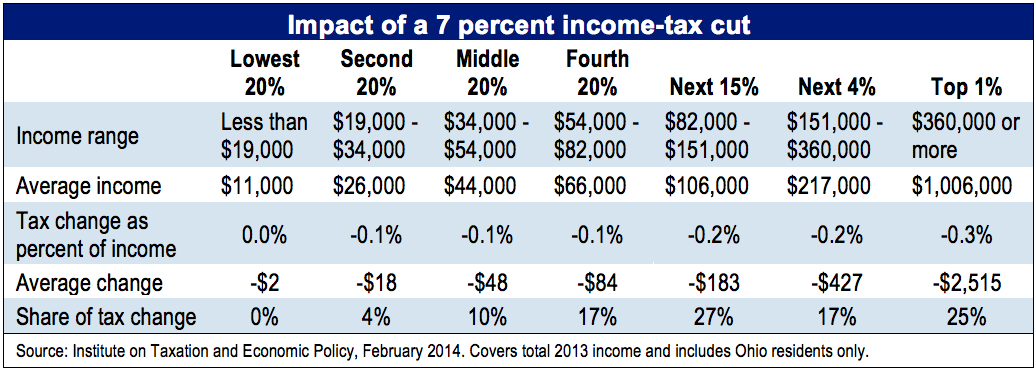

These are the conclusions of an analysis done for Policy Matters Ohio by the Institute on Taxation and Economic Policy, a Washington, D.C.-based research group that has a sophisticated model of the tax system. The top income-tax rate after the full phase-in of cuts approved last year will be 5.333 percent, down from the previous 5.925 percent and from 7.5 percent a decade ago. ITEP examined the impact of a 7 percent, across-the-board rate cut, which would reduce the top rate to 4.96 percent.[2]

It found that the top 1 percent of Ohio’s taxpayers, who average more than $1 million a year in income, on average would receive a tax cut of $2,515 a year. The middle fifth of taxpayers, who make between $34,000 and $54,000 a year, would average a tax cut of $48, while the lowest fifth of taxpayers would get $2.

“Cutting the Ohio income tax will accomplish two things,” said Zach Schiller, research director at Policy Matters Ohio. “It will further skew the tax system in favor of the most affluent, increasing inequality, and it will reduce the resources badly needed for Ohio’s schools, local governments and human services.”

Only a very small number of Ohioans pay the top rate, which kicks in only for income above $208,500. The top rate is often and erroneously referred to as if it is paid on all taxable income, when in fact it is paid only on taxable income over that amount.

The estimates in the table below show how different groups in Ohio would be affected by an across-the-board 7-percent reduction in rates. The analysis shows that the 60 percent of Ohioans with income below $54,000 a year would receive less than one dollar out of every seven cut in taxes. One out of every four dollars cut in taxes would go to the top 1 percent. Overall, more than 40 percent of the cut would go to the top 5 percent, those Ohioans making more than $151,000.

“One thing another income-tax cut won’t bring Ohio is prosperity,” said Schiller. In 2005, the Ohio General Assembly approved a 21 percent phased-in reduction of income-tax rates. The reason for a reduction of that size was to get the top rate, then at 7.5 percent, below 6 percent.

Since then, Ohio job performance has lagged behind that of the country as a whole. Since June 2005, Ohio is one of just a dozen states that have lost jobs; we have lost a greater share of our jobs in that time than all but two other states, Rhode Island and Michigan. Since January 2011, the number of jobs in Ohio has grown by 3.97 percent; nationally, the figure is 5.02 percent.

Ohio has a graduated income tax, so people pay higher rates on higher levels of earnings. Because of that, across-the-board tax cuts give much more money to the wealthiest Ohioans. This reinforces inequality and adds to the unfairness of the state and local tax system, which is weighted in favor of upper-income taxpayers when all state and local taxes are taken into account.[3] New income-tax cuts would come on top of tax changes approved in the state budget last year that further weighted the tax system against low- and middle-income Ohioans.[4]

[1] “Another Ohio Tax Cut for the Affluent?”, Policy Matters Ohio, Oct. 28, 2013, at http://www.policymattersohio.org/4percent-oct2013

[2] Seven percent is the lowest round-number cut that would bring the top rate below 5 percent.

[3] “Ohio’s state and local taxes hit poor and middle class much harder than wealthy,” Policy Matters Ohio, Jan.30, 2013, at http://bit.ly/Wxng75. This analysis was prepared prior to approval of the state budget (see next footnote).

[4] Patton, Wendy, Zach Schiller and Piet van Lier, ” Overview: Ohio’s 2014-15 Budget,” Policy Matters Ohio, Oct. 3, 2013, Table 1, p. 5, available at www.policymattersohio.org/budget-oct2013

Tags

2014Revenue & BudgetTax ExpendituresTax PolicyZach SchillerPhoto Gallery

1 of 22