Cuts to cities, counties threaten local services

June 24, 2015

Cuts to cities, counties threaten local services

June 24, 2015

Contact: Wendy Patton, 614.221.4505

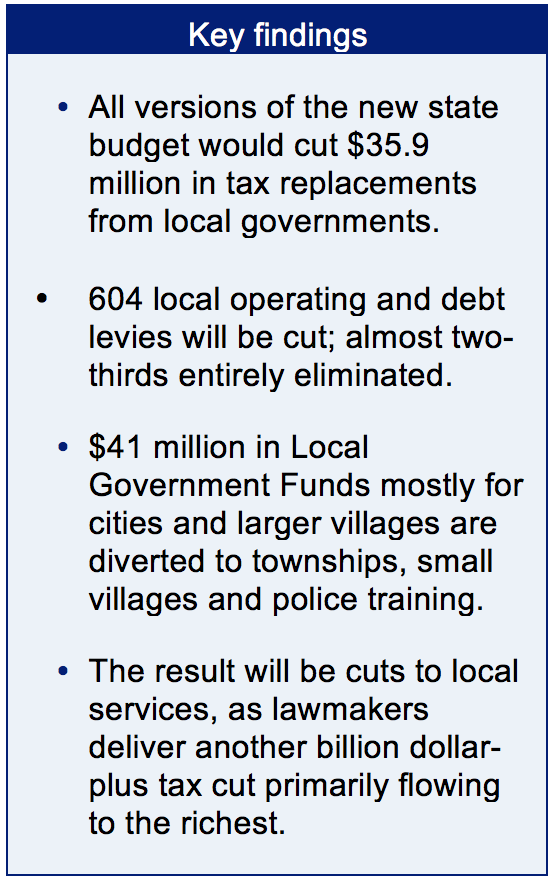

State lawmakers continue their four-year assault on local governments in the budget bill for fiscal years 2016-17,[1] even as the slow recovery continues to be a drag on local revenue collections. At the same time, lawmakers prepare an income tax cut of more than $1 billion that primarily flows to the richest Ohioans.

State lawmakers continue their four-year assault on local governments in the budget bill for fiscal years 2016-17,[1] even as the slow recovery continues to be a drag on local revenue collections. At the same time, lawmakers prepare an income tax cut of more than $1 billion that primarily flows to the richest Ohioans.

Roads and streets are full of potholes and cracks in too many Ohio communities. Thousands of bridges are considered structurally deficient.[2] Public transit agencies are 37.5 million rides short of market demand. [3] Yet Ohio lawmakers are cutting local government and socking the money in savings. Last week we wrote about pending state budget cuts to local levies supporting health and human services. This week, we continue the analysis of cuts aimed at local government operations, from police and fire to roads, bridges, recreation, street lighting and other basics.

Ten years ago, state lawmakers reduced or phased out local tangible personal property taxes[4] on businesses and utilities. Four years ago, they greatly accelerated the phase-out of tax replacement payments promised at that time. At the same time, they cut the Local Government Fund[5] in half. Two years ago, the last of the estate tax[6] vanished. The value of taxable property in Ohio – the backbone of local public finance - has declined since the recession and is not expected to recover until 2017.[7] It has been harder for local government to deliver basic public services that maintain property values, protect safety and enhance quality of life. Yet both House and Senate versions of the new state budget bill would impose new cuts, divert Local Government Funds for new uses, and leave local officials and service providers fighting over limited resources. Local Government Funds could be withheld from some cities because of their use of traffic cameras. Local utility property taxes would be eliminated and the state would establish a new “tax replacement fund,” a target for future elimination, if history repeats itself.Many communities lost tax replacement funding for public services in the budget for 2012-13. According to the Ohio Department of Taxation, 604 local tax levies that support core local operations like police, fire, debt service, road maintenance or other basic public services still get some tax replacement payment.[8] Almost two-thirds will be cut or eliminated in the budget proposal for 2016-17. See the Appendix to understand how your community is affected.

Tax replacements

Ten years ago, state lawmakers reduced or phased out local property taxes on business and utility machinery and equipment and other tangible property. Those taxes had provided significant local revenues. The plan initially reimbursed local governments for the lost revenue, but the replacement was time-limited, with claims that enhanced economic growth would replace revenues over time.

Ten years ago, state lawmakers reduced or phased out local property taxes on business and utility machinery and equipment and other tangible property. Those taxes had provided significant local revenues. The plan initially reimbursed local governments for the lost revenue, but the replacement was time-limited, with claims that enhanced economic growth would replace revenues over time.

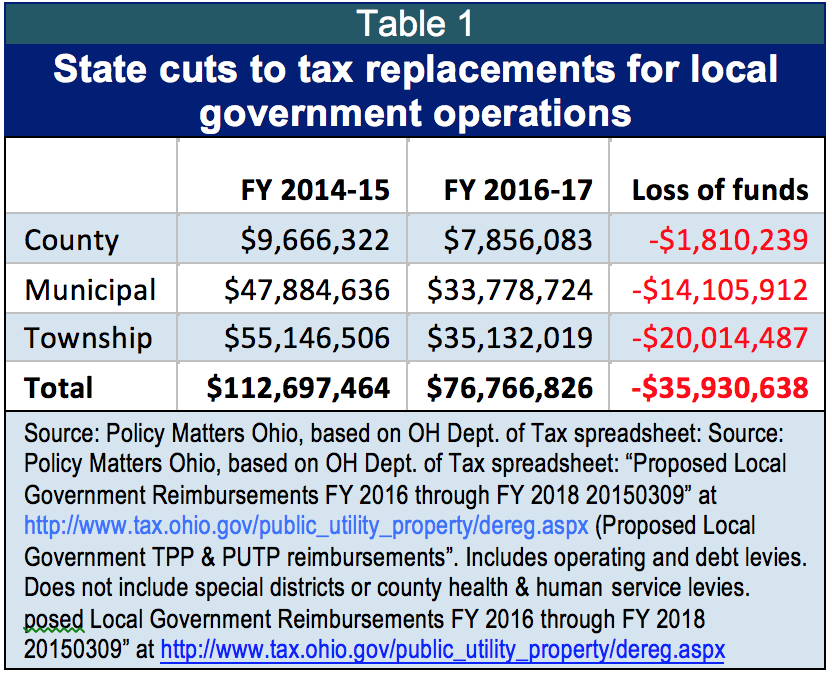

The economy did not grow as anticipated. The value of taxable property in Ohio has fallen and is not expected to regain the value of 2008 until 2017. However, the governor proposed, and the House and Senate supported, phase-out of tax replacements in the pending budget bill. Tax replacements for municipal, county and township operations and debt will be cut by $35.9 million in the proposed budget for fiscal years 2016-17[9] compared to the current, 2-year budget (Table 1.

All communities with tax replacements are cut, but not all losses are equal: The budget would compensate townships and small villages for these cuts, but counties and municipalities would see even deeper cuts from changes to the Local Government Fund, an 80-year-old revenue sharing program.

Local Government Fund

New changes in the Local Government Fund will backfill loss of tax replacements for townships and small villages, but further reduce funding for communities over 1,000 in population.

The Local Government Fund is an 80-year-old revenue-sharing program that provides a percentage of tax revenues collected by the state to local governments: counties, municipalities (including cities and villages), and townships. According to the Ohio Department of Taxation, the Local Government Fund is the only “general purpose revenue sharing” program for local governments. Ohio has other revenue sharing programs – like the sharing of motor fuel tax– but they do not constitute “general purpose” revenue sharing.[10]

Most Local Government Funds flow through counties and are distributed to cities, villages, townships and in some counties, special districts, by formula. There is also a distribution of Local Government Funds given directly to municipalities with an income tax. The municipal distribution was established in 1972 when the state income tax was created, in recognition of the fact that the state income tax would make it more difficult for municipalities to increase local income tax levies.[11]

About $28 million of the approximately $328 million in Local Government Funds distributed in calendar year 2014 was distributed directly to 539 municipalities.[12] A similar amount was provided to these municipalities in calendar year 2013. The budget bill for 2016-17 will change the municipal distribution, targeting it to townships, villages with populations under 1,000 and police training and police relations. Changes include:[13]

- Townships will get $20 million over the biennium, restoring loss from tax replacements. Funds will be diverted from the municipal distribution of the Local Government Fund.

- Villages of less than 1,000 in population will get an additional $4 million over the biennium, also taken form the municipal distribution of the Local Government Fund.

- Because small villages are part of the municipal distribution, the net result of these changes in distribution, according to the Legislative Service Commission, will be as follows: “Decreases [Local Government Fund municipal distribution] transfers to all municipal corporations by a total of $12 million in each fiscal year, but increases transfers to small villages by $2 million, resulting in a net loss to cities and larger villages totaling more than $11 million [a year] and a net gain to small villages of over $1 million [a year].”[14]

- A new “Law Enforcement Assistance Fund” will receive $15 million. This fund would pay for increased hours of training for all police officials across the state. These funds will come from the municipal distribution of the Local Government Fund.

- The Governor's Community Police Relations Task will receive $2 million of county undivided Local Government Funds. These funds will come from the county undivided fund of the Local Government Fund.

- Local governments may lose part or all of their Local Government Funds through proposed laws related to traffic camera use, reporting and penalties.

New “Tax Replacement” Fund

The Senate budget bill contains an amendment to shift public utility taxes on electric generation machinery and equipment to transmission and distribution, a regulated sector in which taxes can be passed on to ratepayers. A new “tax replacement” fund is established for deposit of ratepayer funds to replace lost utility taxes. This $95 million fund could end up being a target for tax cutters in future state budgets.

Winners and losers

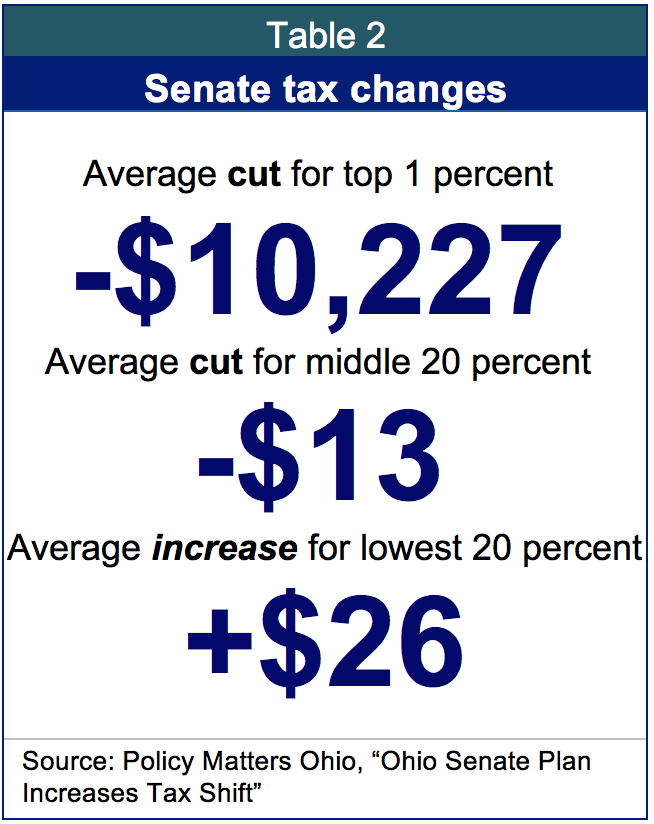

The Kasich administration and the General Assembly repeatedly provides generous income tax cuts that flow to the richest Ohioans while cutting support for local government. Table 2 shows the average tax changes in the Senate-approved budget by income. The majority of Ohioans gain little from the tax cut or even pay more.

The Kasich administration and the General Assembly repeatedly provides generous income tax cuts that flow to the richest Ohioans while cutting support for local government. Table 2 shows the average tax changes in the Senate-approved budget by income. The majority of Ohioans gain little from the tax cut or even pay more.

We all need basic public services. Yet the state budget continues to drain resources from Ohio’s communities. Some of these communities are the poorest big cities in the nation, others suffered deep public employment losses. For example, Akron, Dayton, Hamilton County and Lucas County rank among the 25 local governments identified by Governing Magazine as losing the greatest number of public employees since the recession.[15] Employment loss means services lost. A shuttered recreation center means teens lack a supervised place to play basketball. Fewer police and firefighters means lengthened response time. Unrepaired potholes can damage cars and cause accidents. All these mean not only a poorer quality of life, but a less attractive environment for residents and businesses alike.

An amendment to the Senate budget would take half of Ohio’s Housing Trust Fund for county distribution for housing purposes. The Housing Trust Fund supports affordable housing and homeless shelters throughout the state, leveraging millions of federal dollars for badly needed services. Lawmakers should be investing in more affordable housing, better prevention of homelessness and improving financing for local housing administration, if that is what county officials prioritize.

The state is preparing to boost its own budget reserves by hundreds of millions of dollars. Over the past year, Governor Kasich blasted schools and local governments for what he called swollen budget reserves.[16] Yet the state’s own inconsistent funding of schools and inadequate funding of local government has destabilized local finances, boosted need for reserves, and caused competition for funds where there should be partnership. As a result, county officials and housing agencies fight as the state gives another huge tax cut to rich Ohioans and appropriates hundreds of millions for savings.

New cuts proposed for 2016 and 2017 compound almost a decade of shrunken resources for local services, dating back to the recession. Hamilton County’s budget shrank by a third in the past decade: A jail was shuttered, hundreds of staff laid off, the pace of business services slowed.[17] While the budget has stabilized, it is nearly flat funded in 2015 relative to 2014.[18] A new round of state cuts could threaten stability. Cuyahoga County saw a budget reduction of 6.4 percent in 2014 over 2013 and appropriations remain flat in 2015.[19] Local economies are not strong enough to stimulate a stronger recovery. This remains a particularly bad time for Cleveland and Cincinnati – both of which show up, periodically, on the list of the nation’s poorest big cities.

Big cities are not the only places struggling with the effect of the state’s cuts. The small city of Chillicothe has lost about a million dollars in state aid annually. City officials put a hold on paving city streets and replacing outdated police and fire equipment. Staff have been laid off. The city went to the ballot for new operating funds from taxpayers last year.[20]

Summary and Conclusion

The state budget proposed for 2016 and 2017 once again takes the ax to local government while cutting taxes for the richest. For the past four years, we’ve seen this policy intensify a downward spiral in too many communities. It’s time for a new set of fiscal policies for local government in Ohio:

- Tax replacements should not have been phased out, because they did not yield the economic growth that was forecast. Resuming the phase-out just inflicts more damage to Ohio communities.

- Funds should not be diverted from cities and larger villages to townships and small villages. The reason townships and small villages are in fiscal trouble is that the state has imposed deep cuts on all local governments. The state should restore the estate tax and other cuts to local government instead of diverting funds from one strapped set of jurisdictions to meet the pressing needs of another.

- County officials and non-profits should not be pitted against one another in a fight for limited funds for affordable housing and to prevent homelessness. The deficit in federal, state and local funding for affordable housing drives the crisis in homelessness. Clearly, greater investment in affordable housing needed from all levels of government in all parts of the state. This conflict is shameful in the context of billion dollar tax cuts and hundreds of millions slated for a state savings account.

- Local government funds should be restored to local government, not diverted to new initiatives, regardless of how worthy.

[1] State budget years run from July 1 to June 30; this is called a ‘fiscal year.’ All budget periods in this brief refer to fiscal years unless otherwise noted.

[2] American Road & Transportation Builders Association, based on United States Department of Transportation 2013 National Bridge Inventory, cited in Steve Bennish, “8% of Ohio’s bridges structurally unsafe, report says,” Dayton Daily News, April 24, 2014 at http://www.daytondailynews.com/news/news/local/8-of-ohio-bridges-structurally-unsafe-report-says/nfhFB/. This article reports that 27,015 Ohio bridges are classified as structurally unsafe.

[3] Ohio Department of Transportation, Ohio statewide transit needs study, “Findings Snapshot” at http://www.dot.state.oh.us/Divisions/Planning/Transit/TransitNeedsStudy/Documents/FindingsSnapshotLetterSize.pdf

[4] This was a property tax on the value of machinery, equipment, furniture and fixtures – on property that was not real estate (land or building).

[5] The Local Government Fund is an important revenues sharing program established in Ohio in the 1930’s. Local governments receive a set percentage of all taxes collected by the state. This is because Ohio is a ‘home rule” state in which many services are delivered locally, services provided by state government in other places.

[6] The estate tax was paid by the heirs of the richest estates in Ohio. It did not affect 93 percent of all estates in Ohio. See Zach Schiller, “Why the Estate Tax is Good For Ohio,” Policy Matters Ohio, June 2011 at http://www.policymattersohio.org/wp-content/uploads/2011/10/EstateTax2011.pdf

[7] Wendy Patton, “Hard Times at City Halls: Localities struggle with damaged tax base, state cuts,” Policy Matters Ohio, January 2015 at http://www.policymattersohio.org/hard-times-jan2015

[8] Ohio Department of Tax spreadsheet: “Proposed Local Government Reimbursements FY 2016 through FY 2018 20150309” at http://www.tax.ohio.gov/public_utility_property/dereg.aspx (Proposed Local Government TPP & PUTP reimbursements)”.

[9] All budget periods referred to here are on the state’s “fiscal year” basis, which runs from July 1 to June 30. If a calendar year is referred to, it is indicated in text adjacent to the years under discussion.

[10] Christopher Hall, “A History of the Local Government Fund and the Local Government Revenue Assistance Fund,” Ohio Department of Taxation at http://www.tax.ohio.gov/portals/0/research/LGF_presentation.pdf

[11] Id.

[12] Ohio Department of Taxation, LG12CY14.xls at http://www.tax.ohio.gov/tax_analysis/tax_data_series/local_government_funds/publications_tds_local.aspx. Note that the municipal distribution is not the only source of Local Government Funds that cities and villages get: they also get a distribution from the county undivided fund.

[13] Ohio Municipal League Legislative Bulletin, June 19, 2015.

[14] Ohio Legislative Services Commission, Comparison Document for FY 2016-17 budget (“as passed” by house and Senate),” at http://www.lsc.ohio.gov/fiscal/comparedoc131/sp/rdf.pdf

[15] Michael Maciag, Are Some Government Jobs Gone for Good? Governing, June 2015 at http://www.governing.com/topics/mgmt/gov-local-government-employment-revenue.html#data

[16] Charile Boss, Kasich suggests school districts use cash reserves to offset budget cuts, February 15, 2015 at http://www.dispatch.com/content/stories/local/2015/02/15/too-much-savings.html. see also Wendy Patton, “Ohio Schools Cautiously Rebuild,” Policy Matters Ohio, April at http://www.policymattersohio.org/schools-april2015; just over 40 percent of respondents to a survey on school finances had reserve funds of less than 5 percent. See also, Wendy Patton, “Hard Times at City Halls,” Policy Matters Ohio, January 7, 2015 at http://www.policymattersohio.org/hard-times-jan2015

[17] Sharon Coolidge, “Hamilton County Budget has Shrunk by a Third,” October 11, 2013 at Cincinanati.com at http://bit.ly/1GSZLNt

[18] Hamilton County 2015 Budget in Brief at http://www.hamiltoncountyohio.gov/administrator/bsi/budget/BIB15WEB.pdf

[19] 2014-15 Executive Budget Summary, Cuyahoga County, http://council.cuyahogacounty.us/en-US/2014_15-BiennialBudget.aspx

[20] Matthew Kent, “City, County feel the effects of Kasich’s cuts, The Chillicothe Gazette, September 7, 2014 at http://www.chillicothegazette.com/story/news/local/2014/09/06/city-county-feel-effects-kasich-cuts/15206239/

Tags

2015Budget PolicyRevenue & BudgetSmart TransportationTax ExpendituresTax PolicyWendy PattonPhoto Gallery

1 of 22